Subtotal $0.00

Introduction

Vendor transactions and their reconciliation are fundamental for maintaining a clean financial record.

For businesses, vendor management involves not only ensuring that purchases are accurate but also

keeping track of payments, discounts, and returns.

What are vendor transactions?

Vendor transactions are financial dealings between a business and its suppliers, recorded as accounts

payable. These include:

- Purchases made on credit

- Payments made to suppliers

- Returns or credits from vendors

Why vendor reconciliation is important

Vendor reconciliation ensures that the amounts recorded in your accounting system match the

statements from your suppliers, ensuring no discrepancies in your financial statements. It helps:

- Prevent errors and fraud

- Ensure you don’t overpay

- Manage cash flow effectively

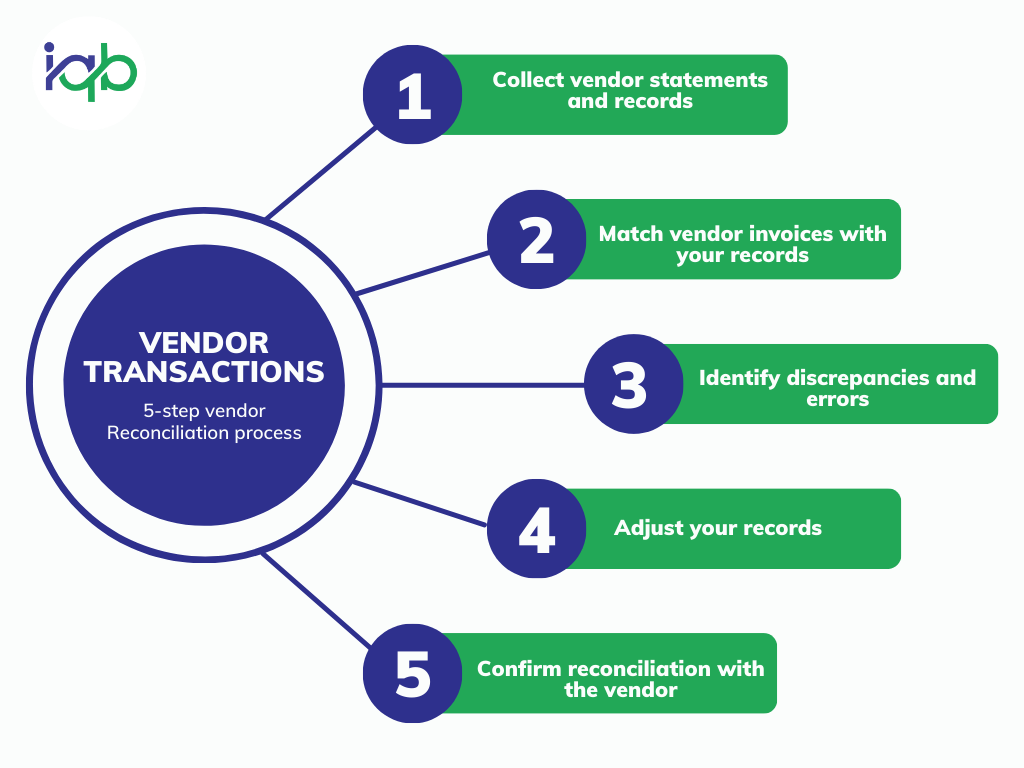

Steps for vendor transaction reconciliation:

- Record all transactions accurately: Every purchase and payment should be recorded

immediately. - Cross-check vendor statements: Verify invoices and payments with your vendor statements.

- Investigate discrepancies: If you find differences, investigate them promptly to avoid

financial issues.

Common Challenges in Vendor Reconciliation

- Unmatched invoices: Missing or incorrect invoices can cause confusion.

- Vendor statement errors: Sometimes, the statement provided by vendors may not reflect all

payments made. - Data entry mistakes: Manual entries can sometimes be inaccurate, especially when tracking

large volumes of transactions.

Best Practices to Avoid Mistakes: - Use accounting software to automate and track vendor transactions.

- Maintain an organized filing system for invoices and payments.

- Reconcile accounts regularly, preferably monthly, to catch errors early.

Conclusion:

Regular reconciliation of vendor transactions is a vital practice for maintaining financial accuracy and

avoiding costly mistakes. A systematic approach will save time, reduce errors, and ensure better cash

flow management.